maine excise tax credit

In Maine you may deduct the sales taxes paid on the purchase of a new vehicle. As of August 2014 mil rates are as follows.

Welcome To The City Of Bangor Maine Excise Tax Calculator

On - Session - 127th Maine Legislature.

. How much is the credit Well the excise tax you already paid was 44100 and the excise tax on the car youre registering today is 26350. 1258 would have doubled the excise tax on cigarettes to 400 a pack. When it comes down to Maines sales tax on cars youre only taxed on the 5000 credit not the 13000 you bought it for.

Maine In Focus. 2019 -- 1000 per 1000 of value. 2021 -- 1750 per 1000 of value.

An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident or totally junked or abandoned in the same registration year is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. An Act To Allow a Motor Vehicle Excise Tax Credit for a Vehicle No Longer in Use.

It says car registration isnt tax deductible in Maine. 2018 -- 650 per 1000 of value. Please sign and date in.

Excise tax is an annual local town tax paid at the Town Hall where the the vehicle resides for over six 6 months of the year. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. MAINE OFFICE OF TOURISM.

By Maine Heritage Policy Center. Environmental Fees Ground Water Tax - offsite. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to excise tax.

2020 -- 1350 per 1000 of value. Neither bill passed but both have carried over to this years. The Maine EIC is available to Maine individual income tax taxpayers who properly claim the federal earned income tax credit on federal Form 1040 or Form 1040-SR or who are otherwise eligible to claim the federal credit except that they filed a federal individual income tax return using an IRS-issued Individual Taxpayer Identification Number ITIN or had no qualifying.

SOLVED by TurboTax 900 Updated December 23 2021. Knowingly supplying false information on this form is a Class D Offense under Maines Criminal Code punishable by confinement of up to one year or by monetary fine of up to 2000 or by both. The credit is available only if the vehicles ownership is.

In this case the total selling price of your vehicle comes out to 8000. Narratives IFTAIRP Refund Programs. 2022 -- 2400 per 1000 of value.

Knowingly supplying false information on this form is a Class D Offense under Maines Criminal Code punishable by confinement of up to one year or by monetary fine of up to 2000 or by both. Generally excise taxes cant be deducted on your personal return. Mil rate is the rate used to calculate excise tax.

36 MRSA 1482 sub-5 as amended by PL 2011 c. YEAR 1 0240 mil rate YEAR 2 0175 mil rate YEAR 3 0135 mil rate YEAR 4 0100 mil rate YEAR 5 0065 mil rate YEAR 6 0040 mil rate. Our office is also staffed to administer and oversee the property tax administration in the unorganized territory.

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. DYER LIBRARY SACO MUSEUM. Four Issues with Proposal to Increase Tobacco and Vapor Taxes in Maine.

Excise Tax is an annual tax that must be paid prior to registering a vehicle. An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward the tax for any number of vehicles regardless of the number of transfers that may be required of the owner or lessee in that registration year. That now includes buses manufactured 2006 and newer.

However some states and localities erroneously label excise taxes as personal property taxes which may be. This includes things like fuel taxes and excise taxes paid to your city or state when you sell your home. According to the instructions on the Maine website you can take a deduction on your Maine tax return for most of the itemized deductions that you take on the federal return and this would include the personal property tax that you paid.

Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper. You must always come to Town Hall first to. During last years legislatures special session in Maine two bills HP.

The State of Maine will reimburse Municipalities for the difference between the excise tax based on the sale price and the Manufacturer Suggested Retail Price MSRP on vehicles that are 1996 or newer and registered for a gross weight of more than 26000 lbs. Individual income tax credits provide a partial refund of property tax andor rent paid during the tax. Calculation will be based on.

Property Tax Educational Programs. Maine Property Tax Institute online - May17-18 2022 Registration. 2017 Older -- 400 per 1000 of value.

Maine Property Tax School Belfast August 1-5 2022 IAAO Course. By signing this claim for credit of excise tax report the licensee understands that false statements made on this form are punishable by law. Visit the Maine Revenue Service page for updated mil rates.

Be it enacted by the People of the State of Maine as follows. Who has paid the excise or property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward the tax for any number of vehicles regardless of the number of transfers that may be required of the owner or lessee in that registration year. I paid excise tax on 2 vehicles.

WHAT IS EXCISE TAX. Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief. Excise Tax Credit Summary Report Rev.

Excise Tax Credit Summary Report. 240 13 is further amended to read. Or rather you would include it along with your other sales taxes paid in lieu of the alternative choice of taking a deduction for state sales taxes paid.

Pennsylvania Base And Elevation Maps Pennsylvania Carbondale Map

Excise Tax Information Cumberland Me

Maine Sales Tax On Cars Everything You Need To Know

M K Gandhi Early Life Freedam Struggle Gandhi Quotes On Education Gandhi Life Gandhi Irwin Pact

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation

Proposed Increase In Real Estate Excise Tax Results In Outpouring Of Public Input News Dailyrecordnews Com

Nj Car Sales Tax Everything You Need To Know

Form Gst Itc 1 Is A Quarterly Return True Or False A True B False Gstquiz Goodsandservicestax Gstfornewindia Aspireinstit True False Goods And Services

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

2022 State Income Tax Rankings Tax Foundation

Pin By Sharath Chandra T On Academic Books In India Syllabus Management Education

Maine Vehicle Sales Tax Fees Calculator

Maine Sales Tax Small Business Guide Truic

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

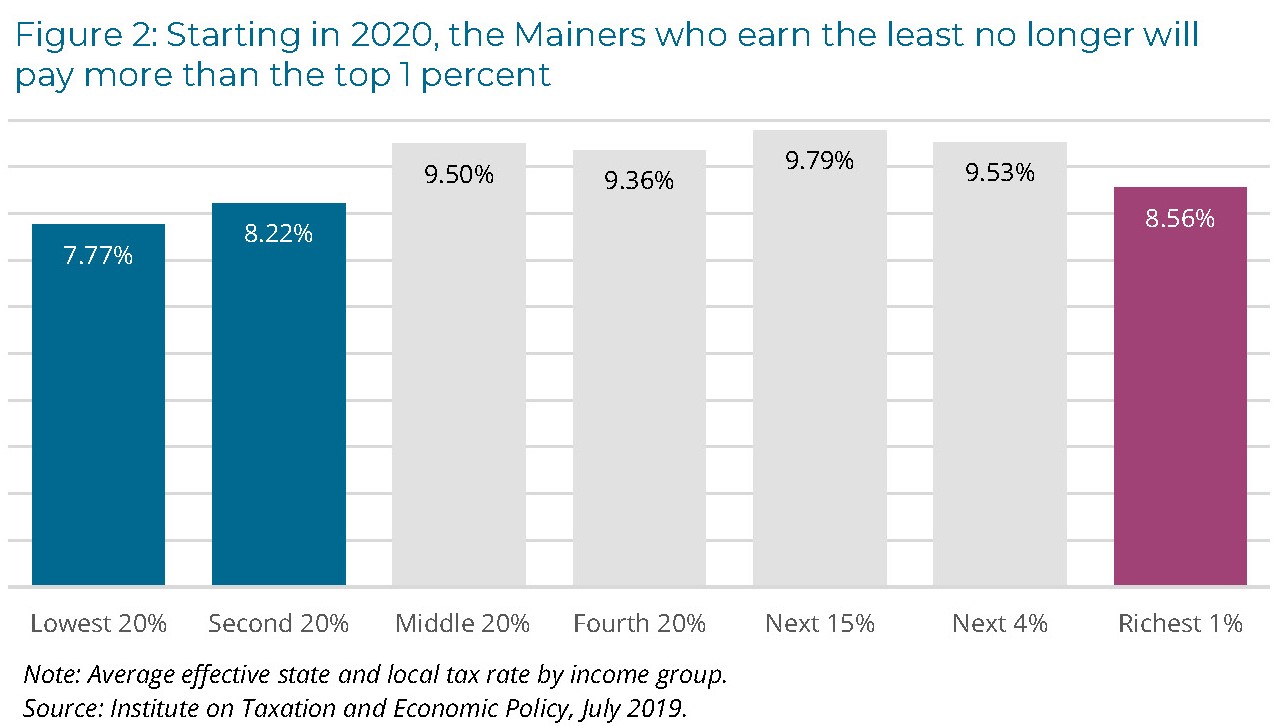

Maine Reaches Tax Fairness Milestone Itep

Rising Gas Prices Excise Tax Refund Offers Relief Tip Excise Tax Recovery Services